Our companies are backed by the Best Pick Guarantee. Call one today!

Living in a major city, I hear the wail of sirens as emergency vehicles speed down the interstate almost every day—at the office, at home making dinner, or while I walk my dog in the evening.

It’s a natural part of the urban soundscape, as commonplace as honking horns or your neighbor’s unfortunate—and unfortunately loud—taste in music, but hearing a siren is nonetheless unsettling. I wonder what happened and if anyone got hurt, and I remind myself to be thankful that, at least for today, I wasn’t the one placing the emergency call.

Best Pick Companies Maintain “A” Grades Annually. Contact One Today!

Be it a plumbing emergency or the storm of the century, our homes are vulnerable to a number of expensive crises. Depending on severity, home emergencies can displace families for days or months at a time, incurring costs for repairs and replacements, as well as related and often overlooked expenditures, such as temporary lodging or eating out while the kitchen is inaccessible.

Proper financial planning and establishing a home emergency plan can help.

You can’t see the future, but you can protect your investment by learning which natural disasters are common to your area, purchasing the necessary insurance coverage, and establishing a hearty emergency savings fund.

Natural Disaster Risk

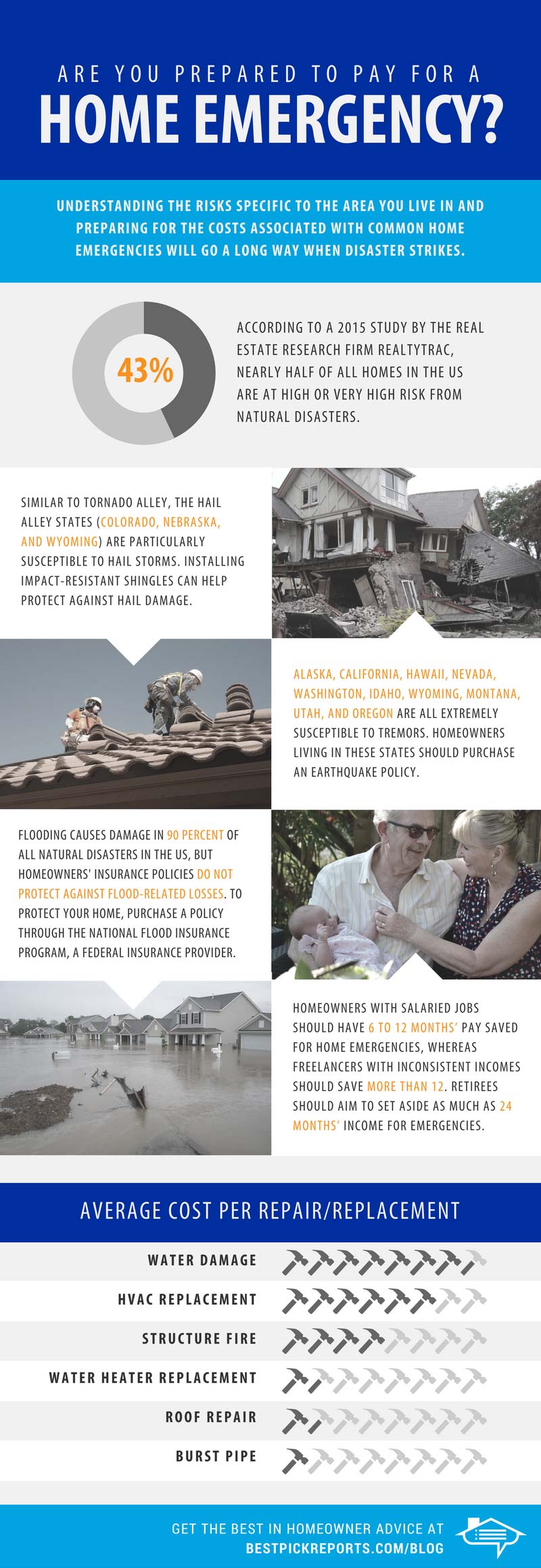

According to a 2015 study by the real estate research firm RealtyTrac, nearly half of all US homes are at high or very high risk from natural disasters.

Understanding the risks specific to the area you live in and preparing for the costs associated with common home emergencies will go a long way when disaster strikes.

Flood damage

Flooding causes damage in 90 percent of all natural disasters in the US, but homeowners’ insurance policies do not protect against flood-related losses. To protect your home, purchase a policy through the National Flood Insurance Program, a federal insurance provider.

Earthquake damage

Alaska, California, Hawaii, Nevada, Washington, Idaho, Wyoming, Montana, Utah, and Oregon are all extremely susceptible to tremors. Homeowners living in these states should purchase an earthquake policy.

Hail damage

Similar to Tornado Alley, the Hail Alley states—Colorado, Nebraska, and Wyoming—are particularly susceptible to hail storms. Installing impact-resistant shingles can help protect against hail damage.

How Much Should You Save for Emergencies?

Homeowners with salaried jobs should have 6 to12 months’ pay saved for home emergencies, whereas freelancers with inconsistent incomes should save more than 12. Retirees should aim to set aside as much as 24 months’ income for emergencies.

Average Cost of Common Home Repairs

The average cost of replacement or repair jobs varies depending on the severity of the damage, but in general, most common home emergencies require a dip into a hearty savings account to resolve.

- Water damage: ~$7,500

- HVAC replacement: ~$6,000

- Structure fire: ~$4,000

- Water heater replacement: ~$1,500

- Roof repair: ~$1,500

- Burst pipe: ~$1,000

Homeowners living in flood- or fire-prone areas, or who live in extremely hot or cold climates, should take extra precaution when preparing an emergency fund.

Don’t Wait—Prepare for Home Emergencies Now

You home is your biggest investment. Safeguard it and your family against common home emergencies by doing the following:

- Learn which natural disasters affect your area.

- Make sure your insurance policy covers these risks.

- Create a home emergency plan with your family.

- Establish an emergency savings fund.

Many local, Best Pick contractors offer 24/7 emergency services and will quickly respond before the damage can spread or the situation becomes dangerous.

If your home sustains fire or water damage, don’t wait to contact a professional. A disaster restoration contractor will help restore your home to a safe, livable condition, so you and your family can get back to normal as quickly as possible.